|

Leon County

Board of County Commissioners Agenda Item#20 March 21, 2023 |

| To: | Honorable Chairman and Members of the Board |

| From: | Vincent S. Long, County Administrator |

| Title: | Award for the Exclusive Franchise to Provide Waste Collection Services in Unincorporated Leon County |

| Review and Approval: | Vincent S. Long, County Administrator |

|

Department/Division Review and Approval: |

Alan Rosenzweig, Deputy County Administrator |

|

Lead Staff/ Project Team: |

Maggie Theriot, Director, Office of Resource Stewardship |

Statement of Issue:

This item seeks Board direction in establishing residential and commercial rates in awarding the exclusive franchise to provide waste collection services in unincorporated Leon County to Waste Pro of Florida, Inc.

Fiscal Impact:

This item has a fiscal impact to the County. The County currently receives a 5% franchise fee from the solid waste contractor. Based on the initial low bid, the County could receive an additional $185,000 estimated annually. However, as detailed in the agenda, the County may reduce the franchise fee to 3%, keeping the revenue stable while mitigating rate increases to subscribers. Franchise fee revenues are necessary to support the County’s solid waste program.

A monthly subscription will be paid by residents opting to receive curbside residential or commercial solid waste collection service in unincorporated Leon County beginning on October 1, 2023.

Staff Recommendation:

Option #2: Board direction.

Report and Discussion

Background:

Leon County is authorized by Section 403.7063, Florida Statutes, and Article VI of the Leon County Code of Laws (Code) to provide for the collection of solid waste in unincorporated Leon County. Pursuant to Section 18-56 of the Code, the County may approve an exclusive franchise for the collection of solid waste collection services. An exclusive franchise ensures the most competitive rates are procured for this service. An exclusive franchise also requires the vendor to provide this service to any unincorporated area resident or business that wishes to subscribe.

The County’s current contract for unincorporated area waste collection services will expire on September 30, 2023. At the February 21, 2023 Board meeting results of the recent invitation to bid (ITB) were presented (Attachment #1). In response to the bid results, the Board directed the County Administrator to conduct negotiations with the low bidder, Waste Pro of Florida, Inc (Waste Pro). Negotiations were based on the scope of service outlined in the ITB and focused on reducing the commercial rates while constraining any increase in the residential rates. Negotiations resulted in four options. Each of the proposed options keep the residential rate below the state average and correspondingly reduce the commercial rate. A detailed explanation of the four options is presented in the Analysis section of this item.

The franchise agreement (Attachment #2) includes the exclusive collection of residential solid waste, recyclable materials, yard debris, and bulky waste on a subscription (i.e. voluntary) basis. By subscribing, residents pay for the convenience of weekly curbside collection. Currently an estimated 30,000 residents in the unincorporated area subscribe. Additionally, the agreement grants an exclusive franchise for commercial collection service in unincorporated Leon County. Commercial services are provided at an estimated 400 sites. The vendor is also required to offer commercial recycling collection service within the unincorporated area.

In September 2022, the Board approved the issuance of the ITB for the exclusive franchise. The ITB was advertised in September 2022, one year ahead of the expiration of the current contract to ensure ample time for any transition of providers. Four bids were received by the ITB deadline; however, based on the minimum requirements of the ITB only one bid was ultimately deemed responsible and responsive. Rather than present only one bid to the Board on such a critical service, and to generate additional competition, the County Administrator rejected the bid in accordance with the Board’s Purchasing Policy. Minor modifications were made to the bid specifications, and the revised bid was immediately readvertised.

In January 2023, three responsible and responsive bids were received as a result of the readvertisement, with Waste Pro being the lowest responsive and responsible bidder (Attachment #3). While the lowest responsible bid constitutes a significant increase to the current residential subscription rate, this residential rate is comparable to the residential rate charged in other counties and remains below the average across the State. By contrast, Waste Pro’s bid includes commercial rate increases of 58% - 116% depending on the type of waste container. Although the residential rates in the Waste Pro bid are aligned with the state average, commercial rates in the Waste Pro bid exceed market rates.

Consistent with state and national trends, the Waste Pro low bid of $23.17 did represent an increase over current residential subscription rates; however, the extent of the increase was abated with intentional adjustments to the scope of service in the franchise agreement as detailed in prior agendas. In part the rate increase represents a return to market norms, as County rates have been disproportionally low for the past decade with customers currently paying 75% less than residents in other counties in the State. Residents are paying this reduced rate as the direct result of the County’s competitive procurement in 2013. In addition, to keep rates as low as possible under the current franchise agreement, the County negotiated the current rates for a three-year contract renewal in 2019. These efforts suppressed the current rate to lower than it was for residents in unincorporated Leon County a decade ago.

Further building on efforts to mitigate cost increases, an item was presented in February 2023 containing two approaches for Board consideration (Attachment #1). First, award a new exclusive franchise agreement to Waste Pro as the lowest responsive and responsible bidder. This approach would result in higher residential rates that are comparable with the state average, but commercial rates would increase beyond market comparisons. Alternatively, the Board opted to proceed with a second option, authorizing the County Administrator to negotiate with Waste Pro as the low bidder to reduce the rate increase to commercial customers while keeping the residential rate in line with the state average. The pursuit of negotiations further builds on the extensive efforts to ensure the anticipated cost increase to customers in unincorporated Leon County is mitigated to the greatest extent possible without a reduction in services.

As a result of the County’s negotiations with Waste Pro, the following analysis provides four options that each have a residential rate below the State average and correspondingly reflects commercial rates lower than the rates received in the Waste Pro bid.

Analysis:

As depicted in Table #1, the residential monthly rate of $23.17 bid by Waste Pro is in line with other jurisdictions in the State, including the City of Tallahassee. The level of service provided by the counties listed in Table #1 is consistent with Leon County’s weekly collection of garbage, recycling, yard debris, and bulky service.

Table #1: Residential Rate County Comparison

|

County |

Monthly Rate |

|

Leon / Current Rate |

$15.03 |

|

Leon / Waste Pro bid |

$23.17 |

|

City of Tallahassee |

$23.62 |

|

|

|

|

Alachua |

$26.89 |

|

Escambia |

$27.67 |

|

Lee |

$26.59 |

|

Martin |

$22.75 |

|

Okaloosa |

$29.99 |

|

Osceola |

$27.75 |

|

Santa Rosa |

$33.43 |

|

Sumter |

$25.31 |

|

Suwannee |

$25.00 |

|

Volusia |

$21.83 |

|

St. Lucie |

$23.01 |

|

Average County rate |

$26.38 |

Under the ITB, the Franchise would be awarded based on the residential waste collection service rate to ensure the lowest rate for 30,000 customers. The residential bid rate demonstrates the success of the steps to mitigate cost. However, the existing commercial rates are above market rates, and would increase further under the rates presented in the Waste Pro bid.

The Franchise also includes commercial waste collection service. There are approximately 400 commercial customers which can select among various container types and the frequency of collection. Though commercial waste collection is exclusive, the vendor does not have an exclusive right to collect commercial recycling, but must provide such service upon customer request. The ITB required the vendor to provide a “not to exceed” rate for various container types. Despite submitting the low bid, under the Waste Pro bid commercial customers would have seen rate increases of 58% - 116% depending on the type of waste container.

Table #2: Commercial Bid Rate

|

Container Type 1 |

# of Customers |

Current Rate |

Waste Pro Bid Rate |

% Increase |

|

2 Cubic Yard |

75 |

$92.80 |

$146.79 |

58% |

|

4 Cubic Yard |

62 |

$185.59 |

$293.57 |

58% |

|

6 Cubic Yard |

31 |

$278.39 |

$440.36 |

58% |

|

8 Cubic Yard |

63 |

$371.19 |

$587.15 |

58% |

|

|

|

|

|

|

|

95 Gallon Cart |

128 |

$25.27 |

$41.95 |

66% |

|

Compactor |

18 |

$210.56 |

$455.00 |

116% |

Footnote 1: Each category of container type has differing collection frequency. The 2/4/6/8 cubic yard containers and also the 95-gallon carts are serviced weekly, and the rate is per month. The compactors are charged per instance of service, with commercial customers opting for a myriad of frequencies including on-call, weekly, monthly.

As depicted in Table #2, the largest category of commercial accounts are 2/4/6/8 cubic yard containers, making up more than half of the total 400 commercial accounts. The rate increase of 58% is consistent with the residential rate increase (54%). The 18 compactor customers would be most heavily impacted by the pending rate increase. Within this category of commercial accounts, half are large national chains, and half are locally operated business centers or apartment complexes.

As directed by the Board, the County Administrator conducted negotiations predicated upon the existing scope of service and focused on reducing the commercial rates while constraining any increase in the residential rates. Negotiations resulted in four options (Attachment #4) as summarized in Tables #3 and #4.

As part of the negotiations and to further mitigate a commercial rate increase, the County also evaluated reducing the franchise fee. The County currently receives a 5% franchise fee from the solid waste contractor. Franchise fee revenues are used to offset a portion of the County’s solid waste program. Based on the initial low bid, the County could receive an additional $185,000 estimated annually. However, the County may opt to reduce the franchise fee to 3%, keeping the total revenue stable. By reducing the franchise fee, rate increases for commercial customers could be mitigated further.

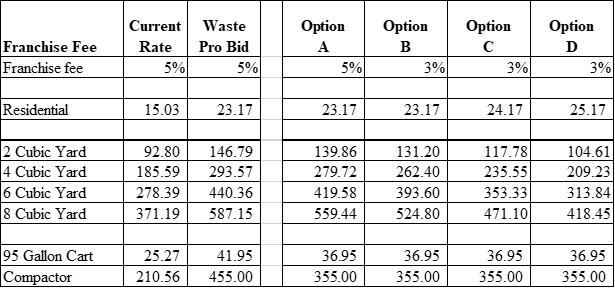

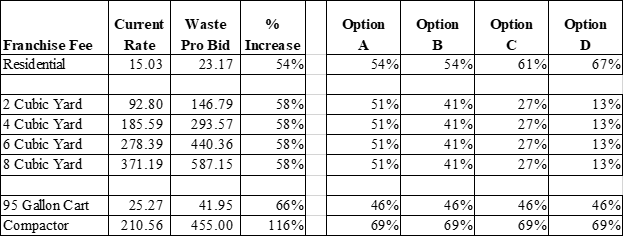

Tables #3 and #4 present the four options. Table #3 displays the four negotiated options compared to the current rates and the Waste Pro low bid. For comparative purposes, Table #4 displays the percentage increase for each of the four options compared to the current rates. The detailed rates for each service type are included in Attachment #4.

Table #3: Negotiated Options - Rates

Table #4: Negotiated Options – Percent Increase Over Current Rate

Option A: Maintains the residential rate at $23.17 and a 5% Franchise Fee. The commercial rates were negotiated to decrease across all service types. As a result, Commercial customers would experience a 51% - 69% increase rather than the 58% - 116% compared to the Waste Pro low bid.

Option B: Maintains the residential rate at $23.17 and reduces the Franchise Fee to 3%. The reduced franchise fee directly mitigates the commercial rate increases. A 3% franchise fee maintains the County’s current revenue collection. The commercial rates were negotiated to decrease across all service types ranging from a 41% - 69% increase compared to the original bid increase of 58% to 116%.

Option C: Increases the residential rate by $1.00 to $24.17 and reduces the Franchise Fee to 3%. This results in a residential rate increase of 61% over current rates. By slightly increasing residential rates, the commercial rate increases can be further mitigated across all service types ranging from 27% - 69%.

Option D: Increases the residential rate by $2.00 to $25.17 and reduces the Franchise Fee to 3%. This rate still remains below the state average. By increasing residential rates $2 above the low bid, the commercial rate increases can be even further mitigated across all service types ranging from 13% - 69%.

As depicted in Table #2, the largest category of commercial accounts are 2/4/6/8 cubic yard containers, making up more than half of the total 400 commercial accounts. In each of the four options, the negotiated approach would reduce the percentage increase in commercial rates. The four options take progressive steps to drive the commercial rate lower.

Option 1 is the only approach that keeps the 5% Franchise fee intact. Options A and B maintain the low bid residential rate of $23.17 for 30,000 residential customers, while Options C and D more heavily prioritize mitigating cost increases to the 400 commercial customers by increasing residential rates $1 and $2 beyond the low bid. As previously noted, the county average is $26.38, therefore each of the four options represent a return to market norms, as the County rates have been disproportionally low for the past decade with customers currently paying 75% less than residents in other counties in the State.

Conclusion

This item includes four options, each achieving the Board directive of conducting negotiations predicated upon the existing scope of service, and focused on a smaller increase in the commercial rates while constraining any increase in the residential rate to remain within the state average. The $23.17 residential rate bid by Waste Pro is comparable to other counties and remains slightly below average compared to rates charged around the State. County rates have been disproportionally low with customers currently paying 75% less than other representative counties in the State.

The County has taken numerous steps to mitigate the full extent of the anticipated rate increase to 30,000 residential customers. Steps include thoroughly evaluating opportunities to modify current level of service, reject bids submitted in response to the initial solicitation, and issuing a new ITB with modified terms. Demonstrating success, the proposed rate increase is slightly below the state market average. Nevertheless, the commercial rates received in the Waste Pro low bid continue to exceed market rates.

Based upon the Waste Pro low bid, the residential rate would be lower than the state average, meanwhile 400 commercial customers would see rate increases of 58% - 116% depending on the type of waste container. Commercial rates have and continue to exceed market rates. As directed by the Board, the County Administrator conducted negotiations with Waste Pro as the low bidder. Negotiations were predicated upon the existing scope of service and focused on reducing the commercial rates while constraining any increase in the residential rates. Negotiations resulted in four options presented for Board consideration. Option A is the only approach that keeps the 5% Franchise fee intact. Options A and B maintain the low bid residential rate of $23.17 for 30,000 residential customers, while Options C and D add $1 increments to the residential monthly fee, and correspondingly further mitigate cost increases to the 400 commercial customers.

Based upon Board direction, staff work will immediately begin to ensure a smooth transition for the October 1, 2023 commencement of services under the new Franchise Agreement. Parameters included in the Franchise Agreement ensure the vendor will transition service with minimal impact to current customers. Although Waste Pro is the current provider, the new Franchise Agreement features extensive standards for transition prior to commencement. In part it is required that the vendor submit a detailed transition plan regarding how the contractor will provide the level of service required consistent with specific performance requirements in the Franchise Agreement.

Staff is prepared to work closely with Waste Pro to ensure the service transition has minimal impact to current customers and all deadlines are met. Detailed requirements and related violation standards are included in the new Franchise Agreement. The County will work closely with the contractor to ensure all customers will be informed of any adjustments to collection procedures, rates, and contact information prior to commencement.

Options:

- Award the exclusive franchise to provide waste collection services in unincorporated Leon County to Waste Pro of Florida, Inc., based upon one of the following rate options, and authorize the County Administrator execute the Franchise Agreement, subject to legal review by the County Attorney.

-

- Residential rate of $23.17, Franchise fee of 5%, and commercial rates as reflected in the item.

- Residential rate of $23.17, Franchise fee of 3%, and commercial rates as reflected in the item.

- Residential rate of $24.17, Franchise fee of 3%, and commercial rates as reflected in the item.

- Residential rate of $25.17, Franchise fee of 3%, and commercial rates as reflected in the item.

- Board direction.

Recommendation:

Option #2 – Board direction.